Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Prediction markets look deceptively simple. Buy “Yes” if you think something will happen. Buy “No” if you think it won’t. Get paid $1 if you’re right.

Retail traders assume the hard part is predicting the future. It usually isn’t.

The real difficulty is navigating fees, thin liquidity, ambiguous rules, and platforms that behave very differently under pressure. Most losses happen quietly, not dramatically.

This guide explains which prediction markets actually matter in 2026, how they behave when money is on the line, and how retail investors should use them without burning time or capital.

Retail investors are drawn to prediction markets for one reason: clarity.

There’s no leverage math, no balance sheets, no earnings models. You are making a binary call. Either the event happens or it doesn’t.

That simplicity is appealing, especially to traders who feel priced out of traditional markets or overwhelmed by complexity.

But simplicity at the surface hides complexity underneath.

Retail users come to prediction markets with different unstated goals.

Each of those goals points to a different platform choice. Using the wrong one is how frustration starts.

A prediction market contract settles at $1 or $0. That is the easy part.

The hard part is price formation. Prices are not calculated. They are negotiated through orders. Whoever shows up with money gets a voice.

If a market has deep liquidity, prices converge toward something meaningful. If it doesn’t, prices drift or freeze.

This is why market mechanics matter more than clever questions.

People love to say “the market thinks there’s a 70% chance.” What they really mean is “the last traded price was $0.70.”

Those are not the same thing.

Prices reflect incentives. Fees, position limits, resolution risk, and capital constraints all distort them. In thin markets, prices often reflect who was online, not what is likely.

Treat prices as signals with context, not answers.

Retail traders assume prediction markets behave like stock markets.

They don’t.

There is no long-term growth. No dividends. No reversion to fundamentals. Every position goes to zero or one.

That changes risk dynamics completely. Overtrading, averaging down, and “waiting it out” behave very differently here.

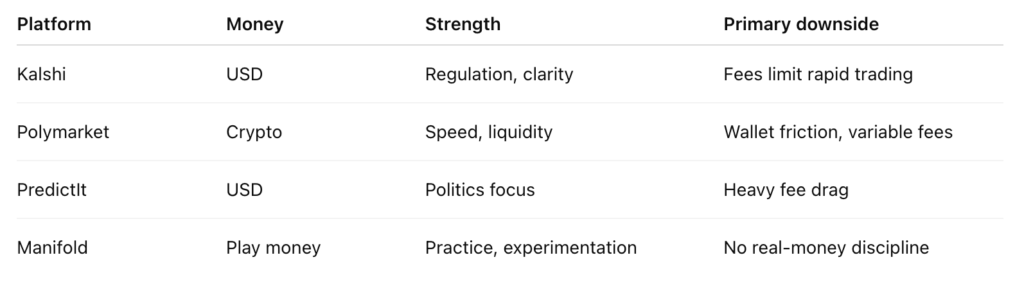

This is the first real fork in the road. Everything else depends on this choice.

Regulated platforms operate under financial oversight and use traditional banking rails. They prioritize rule clarity and compliance over speed.

Markets are fewer, but definitions are tighter. Settlement is boring. That’s a feature.

Crypto-native platforms move faster. Markets appear quickly and update constantly. Liquidity can be deep in the right categories.

You trade speed and flexibility for wallet friction, variable fees, and evolving access rules.

Neither model is superior. They serve different temperaments.

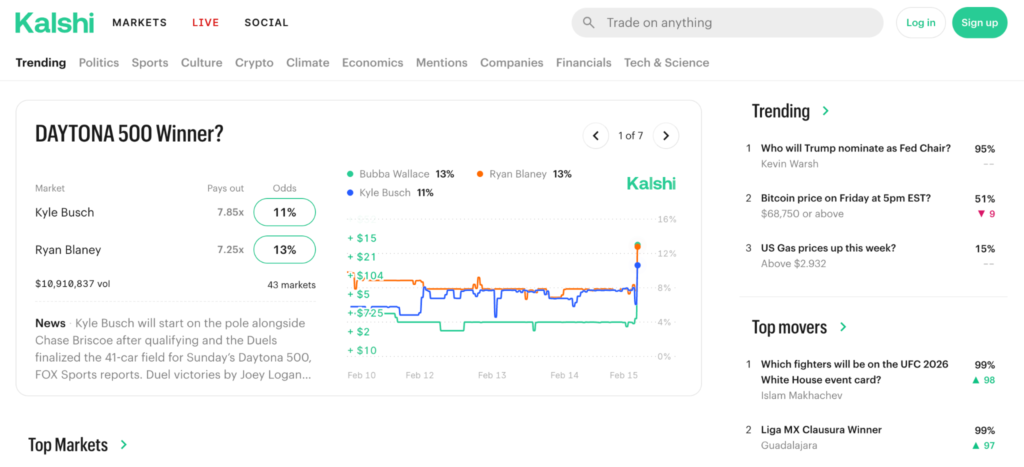

Kalshi is the most important regulated prediction market for retail investors in 2026.

It operates as a US-regulated event contracts exchange. Deposits and withdrawals are in USD. Fees and settlement rules are published publicly.

If you care about knowing exactly what you are trading and how it resolves, Kalshi sets the standard.

Kalshi removes a lot of ambiguity. Market rules are written clearly. Resolution sources are explicit. Fees are formula-based, not hidden.

You don’t have to wonder who decides the outcome or what counts as proof.

That clarity reduces stress, which matters more than most traders admit.

Kalshi charges per-trade fees based on contract price and size. Fees peak around 50/50 markets and fall toward extremes.

This design discourages churning close calls and favors conviction trades where you believe the market is clearly off.

For retail traders, this is both a guardrail and a constraint.

Kalshi fits traders who:

If you want to scalp headlines all day, Kalshi will feel restrictive. That is intentional.

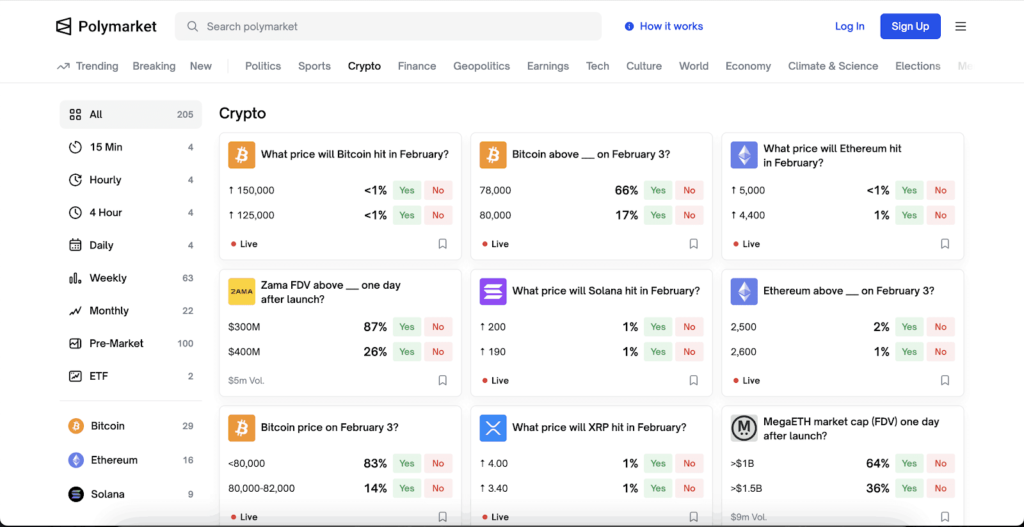

Polymarket is the dominant crypto-native prediction market by volume and visibility.

It attracts traders who want speed, continuous price movement, and deep liquidity in specific categories.

For many retail traders, Polymarket feels more “alive” than regulated alternatives.

Polymarket removes friction. Traders deploy capital instantly via wallets. Orders hit the book without banking delays.

That speed tightens spreads and accelerates price discovery, especially around breaking news.

It also tempts overtrading.

Most Polymarket markets advertise zero trading fees. However, some markets enable taker fees, particularly short-interval or high-churn contracts.

Retail traders often miss this distinction and assume all markets behave the same.

Maker vs taker behavior matters more here than on regulated platforms.

Polymarket fits traders who:

If you want to place a trade and forget it for weeks, this is not ideal.

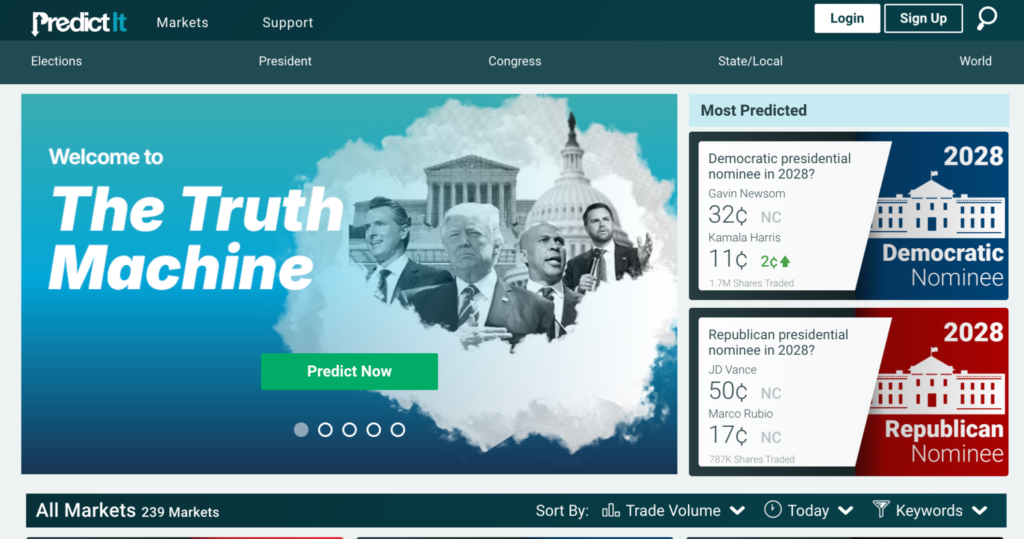

PredictIt remains popular for political markets, largely because of familiarity.

The issue is not market selection. It is economics.

PredictIt charges a profit fee and a withdrawal fee. This fee structure punishes frequent trading and small edges.

A profit fee reduces upside. A withdrawal fee reduces capital efficiency. Together, they compress returns even when you are right.

For retail traders, this means you must be highly selective. Casual trading bleeds slowly.

PredictIt still works for infrequent, high-conviction political bets. Outside that niche, fees dominate outcomes.

Manifold uses play money and community-created markets. It is fast, flexible, and experimental.

This changes incentives. Traders are more expressive and less risk-averse.

That does not make Manifold useless. It makes it a different tool.

Manifold is useful for:

It is not a replacement for real-money incentives, but it is a strong learning environment.

Sometimes. Under the right conditions.

Markets tend to perform well when outcomes are objective, liquidity is high, and arbitrage is cheap. Economic releases and election results often fit this mold.

Markets struggle when outcomes are subjective, rules are vague, or only a few traders dominate volume.

Accuracy is conditional, not guaranteed.

Many retail investors should not trade prediction markets at all.

Watching prices can still be valuable. Markets often reflect shifts in sentiment before headlines catch up.

Use prices to ask:

Is this outcome widely expected?

Is sentiment changing quickly or slowly?

Is new information already priced in?

Ignore markets that move on tiny volume or emotional spikes.

Retail traders love spotting mispriced contracts.

What they often ignore is friction.

Fees, bid-ask spreads, slippage, and settlement delays compound. A two-cent edge can disappear before you exit.

True arbitrage requires deep liquidity and near-zero fees. Those conditions are rare and short-lived.

Position sizing matters more than prediction skill. Binary outcomes go to zero fast.

Prefer objective markets. If resolution requires interpretation, expect trouble.

Read rules every time. The contract text overrides intuition.

Avoid overtrading. Activity feels productive until you check results.

Access rules vary by country and platform.

Always confirm eligibility, withdrawal rules, and restrictions before funding an account.

Most “frozen funds” stories start with skipped terms.

There is no universally best prediction market.

There is only the right tool for your goal.

Use Kalshi for regulated clarity.

Use Polymarket for speed and liquidity.

Use PredictIt sparingly and knowingly.

Use Manifold to learn without risk.

The real edge is not predicting outcomes. It is understanding where friction hides and avoiding it.